China green bonds: Macro tailwind is strengthening

- 24 March 2022 (5 min read)

Green bonds have increasingly attracted the attention of investors engaged in the decarbonisation of their assets. As the green bond market grows, the list of issuers, regions and sectors is becoming increasingly diversified.

While China is among the later comers to ESG investing, the country started to catch up rapidly. Today, China is home to the world’s 2nd largest green bond market, which offers depth, liquidity, and many investment opportunities that worth looking into.

Four reasons we favor the China green bond market:

- The macro tailwind is strengthening: Last year’s power shortage and the current geopolitical conflicts have likely reinforced China’s desire to become energy independence. This matches perfectly with China’s long-term transformation towards a green economy, which the green bond market is developed to support. At the time when global investors are concerned about China’s policy and regulatory uncertainty, the green bond market offers an opportunity for global capital to ‘invest with’ China on a long-term development theme. The latter should ensure policy tailwinds, not headwinds.

- Demand for ‘green’ continues to rise: Over $120 trillion global AUM has signed up to the UN PRI, with Asia’s signatories increasing 3.4 times in the last six years. Increasing investor awareness and regulatory pressure have also led to explosive growth in ESG-focused funds in China, surging 3.5 times in past two years. The People's Bank of China (PBoC) now assesses banks’ green bond business as part of their performance evaluation in green financing. Local governments and state-owned enterprises (SOEs) are also encouraged to tap the market for their green transformation. China may be a later comer to stalling pro-green regulations relative to developed markets, but is moving lightning fast.

- Market too big to ignore: China has been among the top green bond issuers globally since 2016, and is home to the world’s second largest market today after Europe. For local currency bonds, the greater China region accounts for close to 90% of green bonds in emerging markets, while in the hard currency space, China (including Hong Kong) also dominates the Asian market. For investors looking for green bonds with yields, China cannot be overlooked.

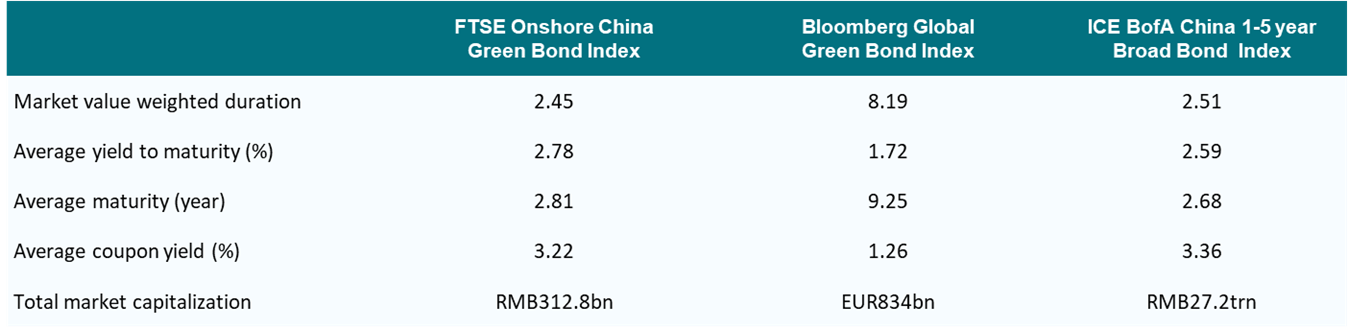

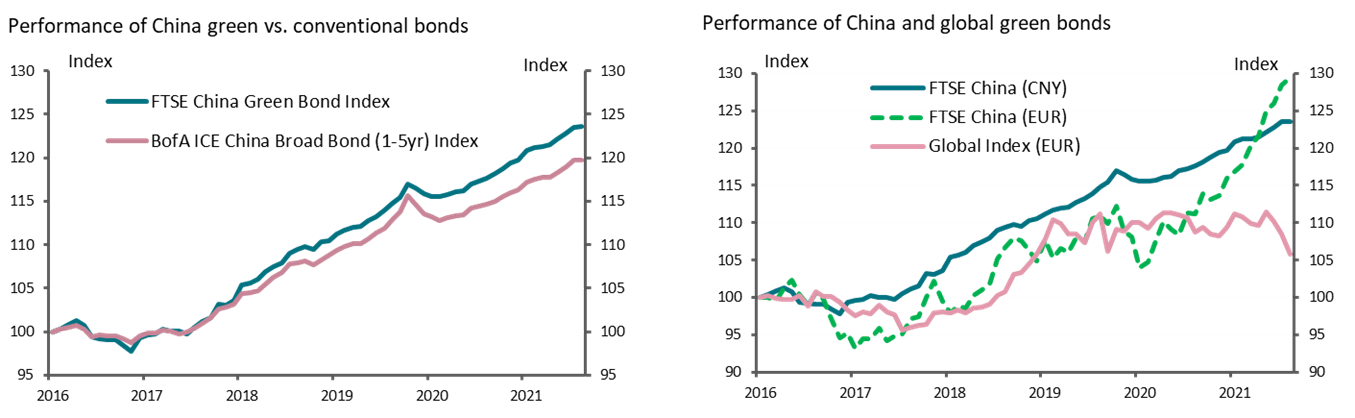

- Growing attractiveness of China bonds: Two common concerns of China green bonds: not green enough as an ESG instrument, and not competitive enough as an asset. On the former, the removal of all fossil fuel projects in the latest edition of China’s Green Bond Catalogue has led to a marked convergence in green bond standards between China and developed markets. For the remaining differences (concerning mainly the use of proceeds), there is adequate info disclosure that allows investors to screen bonds based on customized standards. As an investor under a more stringent green bond framework, we see no impediments to keeping ‘green washing’ risk low for our investment. As an asset class, China green bonds offer higher yields (2.8% vs. global peers at 1.7% and conventional Chinese bonds at 2.6%) and shorter duration (2.5 years vs. global bonds at 8.2 years), and have performed competitively compared to peers in recent years.

Index characteristics of China green bonds, China conventional bonds and global green bonds

Source: FTSE Russel, Bloomberg, and AXA IM Research. As of Feb-2022

China green bonds outperform China conventional bonds and global green bonds

Source: FTSE Russel, Bloomberg, and AXA IM Research. As of Feb-2022

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document.

Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

Disclaimer

This website is published by AXA Investment Managers Asia (Singapore) Ltd. (Registration No. 199001714W) for general circulation and informational purposes only. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities. It has been prepared without taking into account the specific personal circumstances, investment objectives, financial situation or particular needs of any particular person and may be subject to change without notice. Please consult your financial or other professional advisers before making any investment decision.

Due to its simplification, this publication is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this publication is provided based on our state of knowledge at the time of creation of this publication. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

All investment involves risk, including the loss of capital. The value of investments and the income from them can fluctuate and investors may not get back the amount originally invested. Past performance is not necessarily indicative of future performance.

Some of the Services and/or products may not be available for offer to retail investors.

This publication has not been reviewed by the Monetary Authority of Singapore.