Take Two: Eurozone GDP expands in Q4; Japan stocks surge to new high

What do you need to know?

The Eurozone economy grew 0.3% in the fourth quarter, a second official estimate showed – in line with the previous estimate and Q3’s 0.3% growth. That put annual growth for the bloc at an estimated 1.5% for 2025 as a whole, compared to 0.9% for 2024. Separately, European artificial intelligence and defence technology start-ups saw a significant increase in investment activity last year, as total European venture capital investment rose 5% year-on-year to €66 billion, according to Pitchbook. AI-related deals accounted for over 35% of total European venture capital transactions last year, at some €23.5 billion.

Around the world

Japan’s stock market climbed to a new record high last week following Prime Minister Sanae Takaichi’s decisive win in a snap general election on 8 February. Investors hoped the success of Takaichi’s Liberal Democratic Party would help advance an economic stimulus package consisting of several pro-business measures. The election result gave the LDP a two-thirds supermajority in the lower house, the first such result for a single party since Japan’s parliament was established in its current form in 1947. Elsewhere, China’s consumer price index measure of inflation slowed in January to 0.2% year on year, from 0.8% in December, and below expectations.

Figure in focus: $660bn

Capital expenditure on data centres and artificial intelligence infrastructure is set to reach around $660 billion from just four ‘big tech’ firms this year, according to reports. Amazon, Google owner Alphabet, Microsoft and Meta Platforms laid out their planned investment spending alongside their recent quarterly results. This could mean they issue more corporate bonds – Alphabet notably issued a 100-year bond last week – or raise funds in equity markets, dip into cash reserves or return less cash to shareholders, analysts believe. Concerns over whether the spending plans will pay off in terms of AI’s earnings potential were partly behind the recent tech stock volatility.

Chart of the week

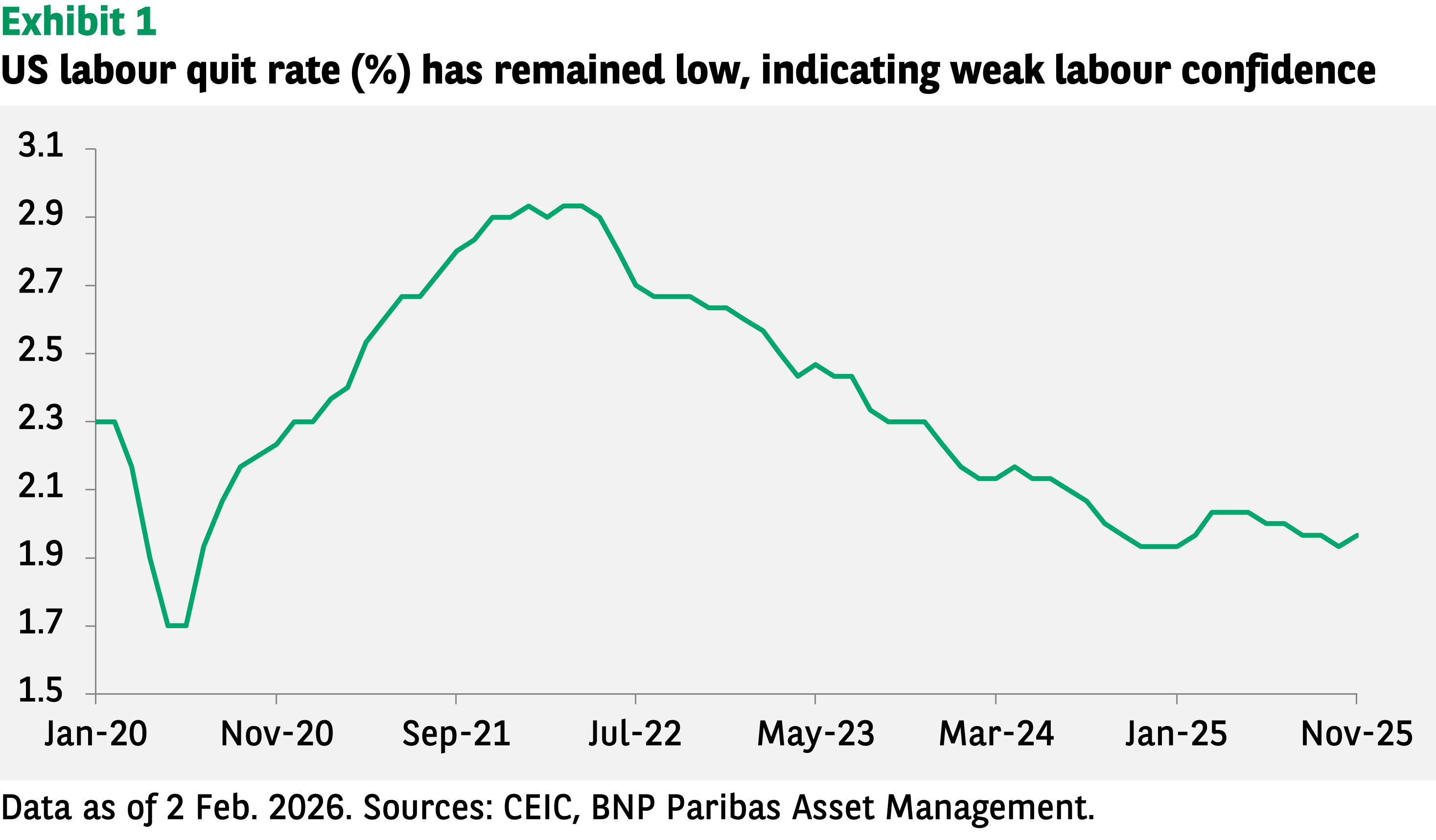

January’s better-than-expected non-farm payroll data was the latest sign of a stabilising US labour market. However, the job gains were narrowly based, echoing other evidence that hiring was sluggish and job security was eroded. These signs indicate weak confidence, as reflected in the low 2% quit rate – suggesting workers are hesitant about voluntarily leaving their jobs as they have little faith in finding new work.

AI-driven productivity gains are curbing demand for labour, raising the prospect of a jobless expansion. In the face of weakening employment prospects and low confidence, the US economy’s resilience could soon be put to the test.

Words of wisdom

Water bankruptcy: A severe, persistent water shortage where damage to key parts of the system such as wetlands and lakes is irreversible. The world has “moved beyond a water crisis and into a state of global water bankruptcy”, according to a recent United Nations report. Around four billion people now experience severe water scarcity for at least one month each year, while the impact of droughts costs around $307 billion annually, it said. Meanwhile more than half of the world’s large lakes have declined since the 1990s and around 35% of natural wetlands have been lost since 1970. The UN urged action to protect natural resources and invest in rebuilding.

What’s coming up?

On Monday, Japan issues a preliminary estimate for fourth quarter GDP growth. Tuesday sees the Eurozone publish the latest ZEW Economic Sentiment Index and Canada reports inflation data, followed by the UK on Wednesday. Also on Wednesday, the Federal Reserve publishes the minutes of its latest meeting where it voted to keep rates on hold at 3.5%-3.75%. Friday sees flash Purchasing Managers’ Indices published, covering Japan, the Eurozone, UK and US.

Read more insights at the Investment Institute

Disclaimer

BNP Paribas Group's acquisition of AXA Investment Managers was completed on 1 July 2025, and AXA Investment Managers is now part of BNP Paribas Group.

This website is published by AXA Investment Managers Asia (Singapore) Ltd. (Registration No. 199001714W) for general circulation and informational purposes only. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute on the part of BNP Paribas Asset Management or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities. It has been prepared without taking into account the specific personal circumstances, investment objectives, financial situation or particular needs of any particular person and may be subject to change without notice. Please consult your financial or other professional advisers before making any investment decision.

Due to its simplification, this publication is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this publication is provided based on our state of knowledge at the time of creation of this publication. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

All investment involves risk, including the loss of capital. The value of investments and the income from them can fluctuate and investors may not get back the amount originally invested. Past performance is not necessarily indicative of future performance.

Some of the Services and/or products may not be available for offer to retail investors.

This publication has not been reviewed by the Monetary Authority of Singapore.