Take Two: IMF raises global growth forecast; Japan’s bond yields jump

What do you need to know?

The International Monetary Fund revised up its 2026 global economic growth forecast and now expects 3.3% expansion, up from the 3.1% predicted in October, with the US and China – and artificial intelligence investment – underpinning much of the improvement. It anticipates a slight slowdown to 3.2% in 2027. However, the IMF warned of potential risks from the concentration of technology investment and ongoing trade disruption. Separately, US GDP growth rose to 4.4% on an annual basis in the third quarter, its fastest pace in two years, and up from Q2’s 3.8%.

Around the world

Japan’s ultra-long term borrowing costs surpassed 4% last week, the highest yield on any Japanese sovereign debt in over three decades. The 40-year bond yields surged as traders sold the country’s debt after Prime Minister Sanae Takaichi called a snap election for February, though yields later fell back. Meanwhile, the Bank of Japan kept interest rates on hold, as December’s inflation rate fell to 2.1% from 2.9% in November. Elsewhere, Eurozone annual inflation came in at 1.9%, down from the flash estimate of 2.0% and November’s 2.1%. US core PCE inflation for November - the Federal Reserve’s preferred inflation measure - was 2.8%, still above target.

Figure in focus: 5%

China’s economy expanded by 5% in 2025, meeting the government’s official target, as a rise in exports helped offset sluggish domestic demand. Fourth quarter growth slowed to 4.5% from Q3’s 4.8%, however. Net exports accounted for almost a third of GDP growth last year, their highest contribution since 1997, despite trade tensions around US tariffs. However, China continues to suffer from a weak property market and subdued household consumption, while its birth rate also fell to a record low last year, underlining long-term structural issues in the world’s second-largest economy.

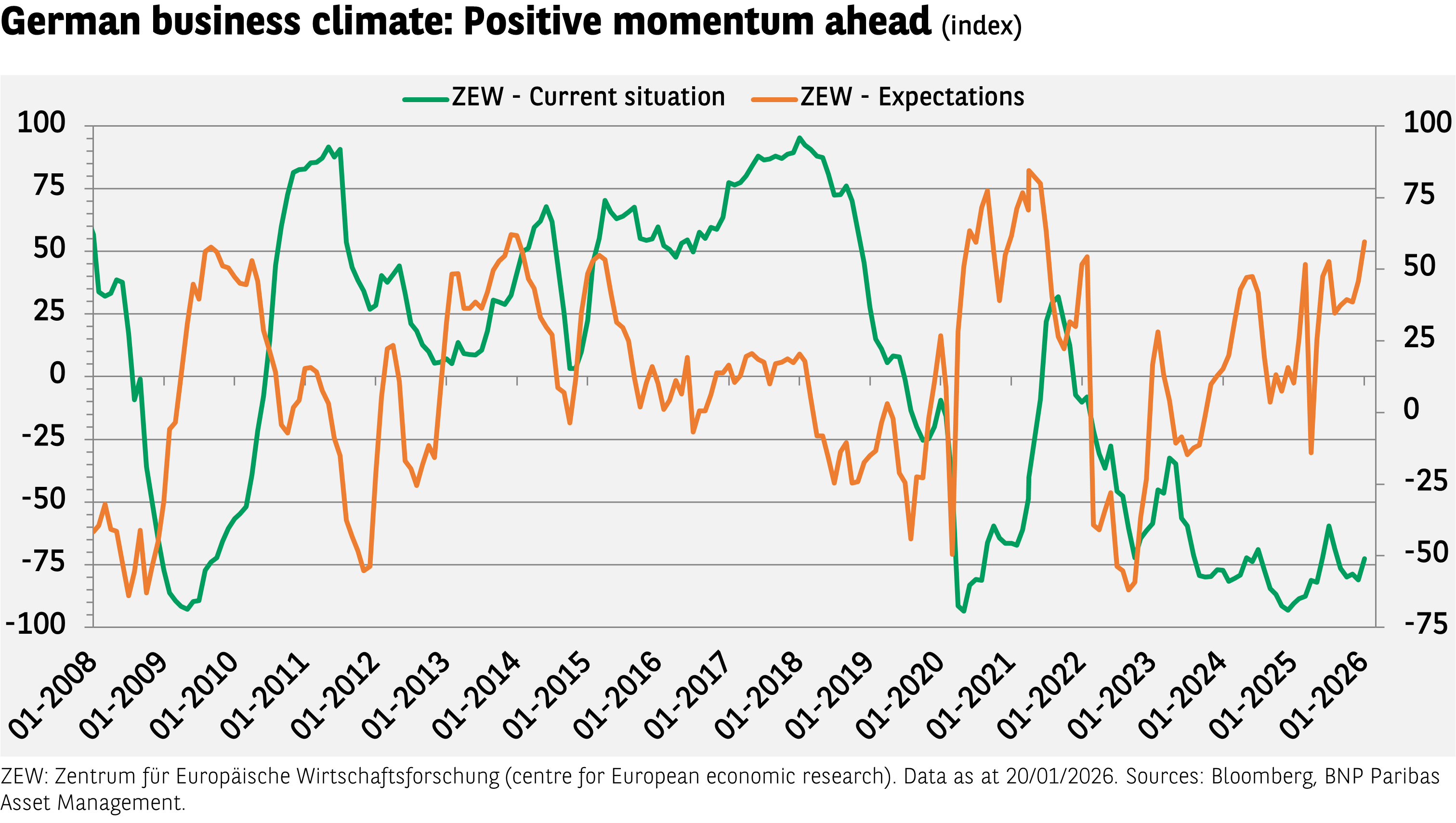

Chart of the week

The ZEW Indicator of Economic Sentiment - a survey of German financial analysts and investors - increased markedly in January, to its highest level since July 2021. This rise signals hopes for a ‘new momentum’, fuelled by Germany’s massive infrastructure and defence spending plans. Order books are on the rise and industrial production at the end of 2025 was significantly higher than expected. The assessment of the current economic situation also improved, albeit more modestly, but is nevertheless encouraging. Is it time to become more confident in Germany’s potential?

Words of wisdom

Creative destruction: A process where new technologies and innovations displace established economic structures, bringing short-term disruption but ultimately shifting capital and labour towards greater productivity and growth. A report from the World Economic Forum published during its annual meeting in Davos found that creative destruction today is powered “less by isolated breakthroughs and more by the combination, convergence and compounding of multiple technologies”. The next wave of technological convergence is being driven partly by robotics moving from factories to human spaces, the WEF said.

What’s coming up?

Germany’s closely watched Ifo Business Climate Index is issued on Monday. On Wednesday, the Bank of Canada and Fed hold their respective interest rate setting meetings – the Fed is widely expected to keep rates on hold. Wednesday also sees the BoJ issue its latest monetary policy meeting minutes. On Friday the Eurozone reports a flash estimate for Q4 GDP growth along with the bloc’s latest unemployment rate.

Read more insights at the Investment Institute

Disclaimer

BNP Paribas Group's acquisition of AXA Investment Managers was completed on 1 July 2025, and AXA Investment Managers is now part of BNP Paribas Group.

This website is published by AXA Investment Managers Asia (Singapore) Ltd. (Registration No. 199001714W) for general circulation and informational purposes only. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute on the part of BNP Paribas Asset Management or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities. It has been prepared without taking into account the specific personal circumstances, investment objectives, financial situation or particular needs of any particular person and may be subject to change without notice. Please consult your financial or other professional advisers before making any investment decision.

Due to its simplification, this publication is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this publication is provided based on our state of knowledge at the time of creation of this publication. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

All investment involves risk, including the loss of capital. The value of investments and the income from them can fluctuate and investors may not get back the amount originally invested. Past performance is not necessarily indicative of future performance.

Some of the Services and/or products may not be available for offer to retail investors.

This publication has not been reviewed by the Monetary Authority of Singapore.