2026 inflation outlook: Navigating uncertainty

KEY POINTS

2025 was another year defined by tension rather than direction. And that tension was most visible in interest rate markets. On the surface, the story looked simple - inflation ‘eased’, growth held up better than feared, and central banks were cutting rates.

In practice, it was more complicated. Governments continued to spend (or announce more spending), deficits widened, and bond issuance increased along with political uncertainty. While policy rates were lower, longer-term yields sold off because of higher term premia. Any rate rally in advanced economies was uneven and with frequent and sharp reversals: a fertile terrain for volatility seekers.

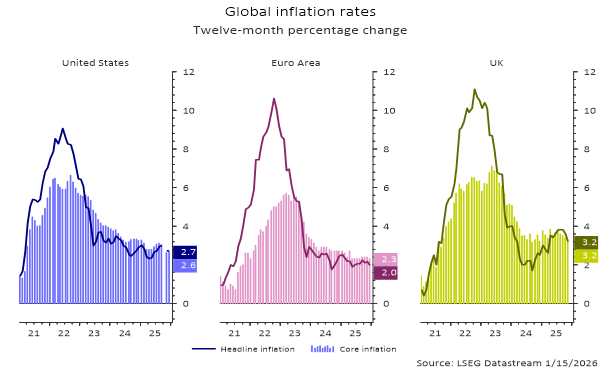

Inflation, meanwhile, refused to quietly fade away. Headline numbers improved, (arguably supported by lower oil prices in an oversupplied market), but they remained well above pre-pandemic levels.

Services inflation stayed firm, labour markets proved somewhat resilient, and pricing power lingered in parts of the economy. As we anticipated last year, this backdrop was supportive for inflation-linked bonds. Inflation accrual mattered again, reminding investors that inflation protection is not just about tail risks, but about income in an uncertain world.

More balance

Looking ahead to 2026, the outlook appears more balanced, though far from benign. Inflation should continue to move closer to central bank targets, but the idea of a clean return to the low-inflation regime of the 2010s looks increasingly outdated. Instead, the key question is not where inflation will land, but how quickly it gets there and how differently the normalisation unfolds across regions.

The US stands out for its persistent inflation. Domestic demand remains strong, and services inflation has been slow to cool. On top of that, the full impact of tariffs has yet to show up in prices. Disinflation is likely to continue but not in a straight line. We can still expect US inflation printing close to 3% this year and for the Federal Reserve this means caution, regardless of who will be the future Chairman.

Europe tells a different story. We expect inflation to fall more quickly, potentially undershooting the European Central Bank’s target in the first part of the year as effects from lower oil prices and stronger currency materialise. Over time, inflation should stabilise close to 2%, but the path there is likely to be smoother than in the US. The UK goes one step further. A faster normalisation process could see inflation end 2026 below current market expectations, supported by softer growth and a potentially weaker labour market.

Growth itself should remain supportive. Beyond artificial intelligence-related investment and wealth effects from the equity rally, fiscal policy will play a central role, particularly in the US and Europe, where public spending should provide a cyclical boost. This reduces the risk of a sharp slowdown and gives central banks room to move carefully. However, with real interest rates still restrictive, the bar for renewed rate hikes is set high, even if policymakers stay alert to upside risks from wages and services inflation.

What does it mean for portfolio allocation?

For investors, this environment calls for a more selective approach. Big directional bets on rates or inflation look less compelling when policy paths are likely to diverge across regions. Instead, returns are more likely to come from carry and specific exposure to inflation risk.

This is where inflation-linked bonds continue to earn their place in portfolios. Inflation risk is currently priced at modest levels, while term premia in many markets look attractive. That combination offers an appealing asymmetry. If inflation proves stickier than expected, inflation-linked bonds provide protection and resilience. If inflation continues to normalise, investors should still benefit from lower real yields and diversification.

The broader lesson of the post-COVID-19 period is that inflation uncertainty has changed, not disappeared. The world has become more fragmented, more fiscal, and more sensitive to political swings. In that context, inflation-linked assets, used thoughtfully, remain a potentially powerful tool for navigating a world where certainty is scarce and where inflation still matters.

Disclaimer

BNP Paribas Group's acquisition of AXA Investment Managers was completed on 1 July 2025, and AXA Investment Managers is now part of BNP Paribas Group.

This website is published by AXA Investment Managers Asia (Singapore) Ltd. (Registration No. 199001714W) for general circulation and informational purposes only. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute on the part of BNP Paribas Asset Management or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities. It has been prepared without taking into account the specific personal circumstances, investment objectives, financial situation or particular needs of any particular person and may be subject to change without notice. Please consult your financial or other professional advisers before making any investment decision.

Due to its simplification, this publication is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this publication is provided based on our state of knowledge at the time of creation of this publication. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

All investment involves risk, including the loss of capital. The value of investments and the income from them can fluctuate and investors may not get back the amount originally invested. Past performance is not necessarily indicative of future performance.

Some of the Services and/or products may not be available for offer to retail investors.

This publication has not been reviewed by the Monetary Authority of Singapore.