Can Europe step into Uncle Sam’s shoes?

KEY POINTS

Europe has always been seen as the little cousin to the US. This year, however, Europe’s profile from an investment perspective has grown as the US’ reputation of a choice of stability and reliability has taken a nose-dive.

With the US’ ability to provide a large market with liquidity and scope, it has been a natural choice for allocators at times of volatility. However, with the recent geopolitical headwinds and uncertain US macro data, investors have been reminded that it may be prudent to look for other potential “safe haven” solutions.

This was experienced in May, when the eurozone’s relative stability and the fear of trade-drive inflation in the US saw investors allocate away from US Treasuries to the better performing option of German Bunds.

While those concerns have settled, the differing economic situations on either side of the Atlantic mean that Europe remains a focus for investors. This positive view for euro fixed income goes beyond simply strong corporate fundamentals and attractive yields.

A favourable macro backdrop

The most recent US data has been mixed with a weak labour market prompting the Federal Reserve (Fed) to lower its interest rates. Alongside this, fears surrounding the Fed’s independency, stemming from heavy pressure from the Trump administration, and around data reliability, following the dismissal of the Bureau of Labor Statistics’ director after downward job revisions over the summer, is adding uncertainty. Eventually, the US Government shutdown hasn’t served to improve the overall picture and has meant we have missed October’s non-farm payrolls and the US CPI release - key prints, not just for the US but for all markets.

While there are more interest rate cuts priced in over the next year, a rebound in inflation or a growth surprise would challenge that path. This in turn could potentially see both underlying yields and spreads move higher if the market is forced to revise its expectations on monetary policy.

Europe is a different story as the market has largely priced out further European Central Bank (ECB) rate cuts for now. Of course, if growth deteriorates meaningfully, any market repricing could push euro-area yields lower again, even if monetary policy remains on hold.

If growth slows and inflation remains contained, markets may price in more duration-friendly scenarios for euro fixed income, lifting prices and flattening the curve in ways that could benefit longer maturities or high-quality euro government and corporate bonds. In particular, if eurozone credit spreads remain reasonably tight while growth concerns are modest, European investment-grade and selective higher-yield euro exposures, we believe could offer attractive carry with manageable credit risk.

From a fiscal perspective, no country – from US to Japan - is being spared its share of woe. Overall, there is a general discontent with how public finances are being managed. Populism and the associated political fragmentation tend to work against governments taking hard decisions on taxes and spending – note the current situation in France and the UK. The US variety of populism has been able to shape the fiscal stance in favour of higher income taxpayers and higher deficits.

We are seeing a bit of a stalemate in the bond markets with long yields stabilising as investors wait for budget news in the UK and France. However, Europe is not made up of just one country. So while a stalemate scenario might be true for France, Germany is actually in a very good position to afford additional fiscal spending. Indeed, the German bund curve remains stable and increases in German fiscal policy are already starting to come through. This, in turn, is providing extra support for European corporates. And there are other countries such as Spain or Portugal that have been through significant efforts over the past decade which should make them relatively immune to a deterioration in growth. Italy, for example, announced recently it will reach the 3% deficit target.

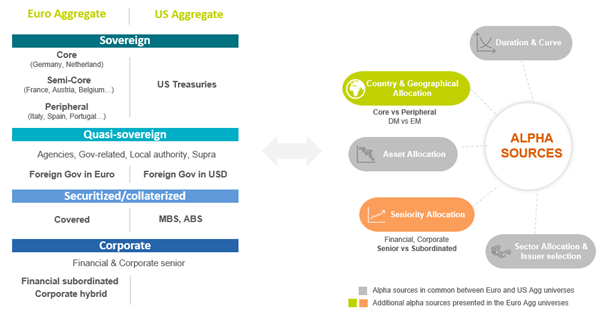

This is, we believe, one of the strengths of euro fixed income; contrary to other regions, euro fixed income has more than one sovereign curve which provides opportunity to position where it is the most appropriate. As illustrated below, euro-denominated bond markets, in comparison with the US, offer unique diversification within a global fixed-income sleeve due to a broad selection of alpha sources.

Euro versus US fixed income composition

Source: AXA IM as of 30 September 2025. For illustrative purposes only and subject to change.

This choice of issuers across geographies as well as sectors and seniority levels provide investors with a range of levers to use in order to find opportunities regardless of the market environment.

Hedging away the troubles?

For global portfolios, euro fixed income offers currency diversification and exposure to the euro area cycle, which can be beneficial if US conditions are different (e.g. weaker dollar or different inflation path). Even when hedged, the diversification value should improve risk-adjusted returns.

Indeed, for foreign investors, euro yields currently look attractive on a hedged basis. The reciprocal is true as well, with euro fixed income more attractive than US hedged fixed income for European investors. The attractiveness of hedged euro fixed income for non-euro investors depends on yields, currency differentials and hedging costs. Those components are highly regime-dependent: policy stance, inflation dynamics, and liquidity conditions shape them. We are, therefore, seeing a bit of a sweet spot where attractive yields and hedging conditions combine to make euro fixed income appealing for non-euro investors.

Euro fixed income offers investors interesting diversification, current hedging benefits and a Central Bank better positioned to act without worrying too much about inflation contrary to the US. While there are numerous headwinds to contend with, and we maintain a view that flexibility is key when it comes to volatility, we believe that there are still attractive opportunities for investors in euro fixed income.

Disclaimer

BNP Paribas Group's acquisition of AXA Investment Managers was completed on 1 July 2025, and AXA Investment Managers is now part of BNP Paribas Group.

This website is published by AXA Investment Managers Asia (Singapore) Ltd. (Registration No. 199001714W) for general circulation and informational purposes only. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute on the part of BNP Paribas Asset Management or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities. It has been prepared without taking into account the specific personal circumstances, investment objectives, financial situation or particular needs of any particular person and may be subject to change without notice. Please consult your financial or other professional advisers before making any investment decision.

Due to its simplification, this publication is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this publication is provided based on our state of knowledge at the time of creation of this publication. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

All investment involves risk, including the loss of capital. The value of investments and the income from them can fluctuate and investors may not get back the amount originally invested. Past performance is not necessarily indicative of future performance.

Some of the Services and/or products may not be available for offer to retail investors.

This publication has not been reviewed by the Monetary Authority of Singapore.