What factor investing can tell us about 2022 and what’s in store for 2023

Key points

- Factor investing allows investors to identify and classify common characteristics of companies which deliver identifiable and repetitive patterns of return

- We believe Value, Quality, Momentum and Low volatility are some of the most important factors in understanding investor behaviour in 2022

- To navigate the year ahead, we believe investors may potentially benefit from a diversified exposure to factors, and that Quality and Low volatility could possibly offer the best combination

Investing in equities has long been associated with reward as well as the potential for short-term risk. While markets have risen and fallen in response to a plethora of reasons, there is some consistency in how investors have responded to each event, and for more than 50 years some investors have identified and classified the common characteristics of companies that have delivered these identifiable and repetitive patterns of return. Today this technique is more commonly known as factor investing.

There are many important academic studies on factors, with perhaps the most famous being “Common risk factors in the returns on stocks and bonds”, written by Nobel prize-winning economists Eugene Fama and Kenneth French. They identified size and value, in addition to beta, as factors that could account for more than 90% of a diversified portfolio’s return. Some years and a wealth of academic studies later, we have an array of factors at our disposal to help quantify risk and understand investment returns.

Rarely has that ability been more useful than in 2022 – 12 rocky months that will likely be analysed and discussed by investors and academics long into the future given the exceptional nature of events. With the effect of the coronavirus pandemic still lingering, particularly in China, war returned to Europe following Russia’s invasion of Ukraine in February and continued to rage as the year ended.

The impact on the world was a rapid rise in inflation, which prompted persistent and, for many investors unnerving, commentary on how far and how fast central banks would raise interest rates to keep price rises in check.

However, through the prism of factors we can better understand investor behaviour in 2022. While there are hundreds of factors that could be considered for this analysis, we believe the most important and academically validated groupings are Value, Quality, Momentum and Low volatility.

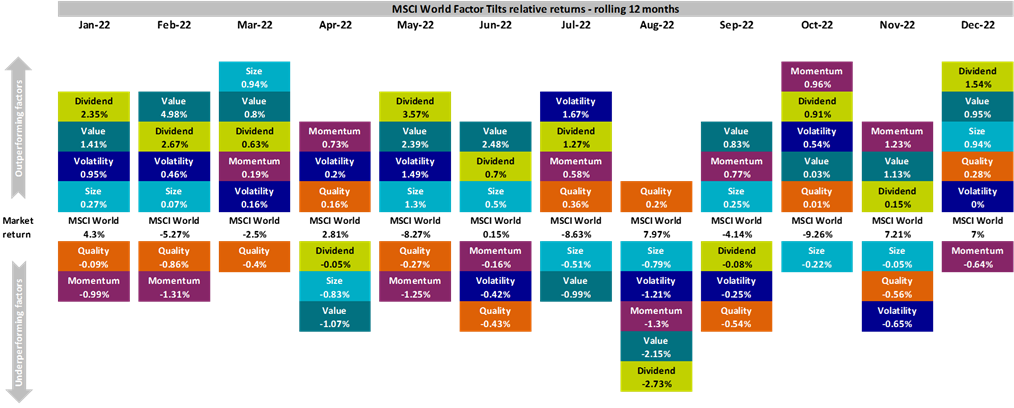

The exhibit below shows how tilt versions of each factor performed relative to the standard MSCI World Index over each month of 2022:

Source: AXA IM, Refinitiv, MSCI. All data in US dollar terms.

Below, we explore each of these, review their behaviour in a dramatic 2022, and then look ahead to see how they could perform in 2023.

Value

Value is about finding underappreciated, and therefore potentially misvalued, stocks. The level of mispricing is subjective, but typically investors analyse a range of fundamentals relative to current share price. These could include items such as book value, trailing and/or predicted earnings, dividends and/or cash flow, to name a few. Value investors seek to arbitrage the price paid now for company fundamentals against a future value they think the stock could be worth.

The prolonged period of ultra-low interest rates prior to 2022 eroded the historical return premia attached to value investing. Low interest rates allowed the discounted cashflow models used by some investors to determine the present value of future cashflows to be generous in their assumptions, with high present valuations derived from the promise of equally high future growth and a low cost of capital.

But with interest rates nearing 5% and corporate earnings expectations falling, these assumptions have been revisited. Furthermore, Value stocks typically offer the prospect of real cash flow in the short term and an earnings yield (the inverse of the price/earnings ratio) above the yield available from lower risk assets, unlike the most richly valued stocks.

This, combined with the dominant performance of cyclical sectors such as energy and financials, left Value as the best performing factor in 2022. This epiphany is both noteworthy in magnitude and welcome for investors who have long weathered headlines that heralded the death of value investing and the rise of the fast-growing asset-lite elite.

Quality

Relative quality can be measured by the level and persistency of a company’s delivered earnings, perhaps some analysis of balance sheet health, and could include analysis of how earnings could grow or decline in the future. Typically, high-quality companies tend to deliver more consistent earnings and may experience less share price volatility.

Quality has had quite an unusual year and has underperformed at a time when it should have been rewarding for investors to hold high-quality companies. Why? Typically, high-quality companies have steady and repeatable cash flows, and may have a protective moat around their profitability, either through some unique product or unusually high barriers to entry in their industry.

Looking at the stocks in the MSCI USA Quality Index at the end of December 2021, however, and comparing them with a growth index, there is a high degree of commonality. Companies such as Apple, Microsoft, Meta and Nvidia are in the top 10 of each. The shocks of 2022 brought into question not only how much of a premium investors would pay for growth, but whether companies can pursue growth at the expense of delivering cash to shareholders.

So, Quality had a reckoning in 2022, both in terms of the price investors pay for Quality and whether Quality itself is sustainable in an inflationary era.

Low volatility

Volatility measures the variation of stock price returns over time. A Low volatility approach seeks to identify those stocks with the lowest levels of volatility in their share prices, in relative terms. These companies typically have stable fundamentals such as strong balance sheets and resilient earnings.

Low volatility had a good crisis. As happened in prior crises, the peak stress months of April, June and September saw rapid flights to stocks with the lowest sensitivity to market movements as investors sought to protect capital. The only factor close in performance terms was Dividend Yield, as the total return component of equities became more important than just the price return.

This natural desire to own lower-risk assets at times of stress is a proven phenomenon, and 2022 certainly added another proof point to the existing evidence. Low volatility investing proved that it can be a potentially useful insurance policy for any asset allocator once again.

Momentum

In its simplest form, Momentum is a measure of the rate of price change relative to the market over a defined period, usually the previous 12 months. High levels of momentum can indicate positive changes to a company’s fundamentals, while low momentum may signal a possible decline in future fundamentals.

A Momentum strategy therefore tries to capture trends in sentiment towards a company, and in academic terms tends to be a measure of share price relative strength. More sophisticated views of this factor can include other features that indicate positive business momentum and could include earnings revisions or media sentiment.

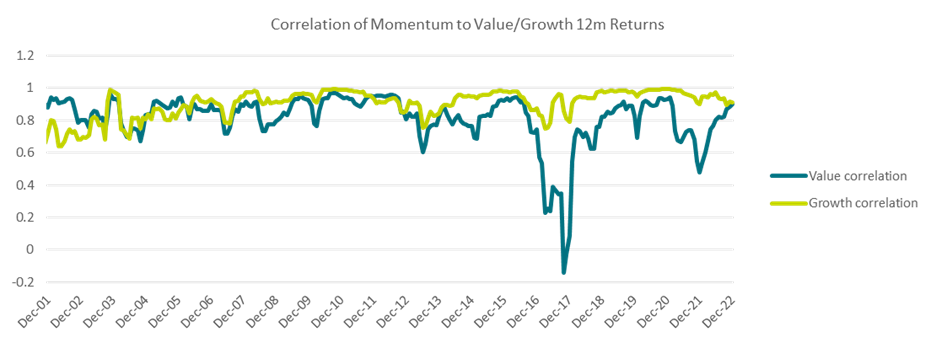

The attractiveness of Momentum investing is that it simply follows market trends, buying stocks that have done well or which the consensus expects to do well. Using 2022 to illustrate this, the exhibit below shows how correlated the rolling 12-month return for the MSCI World Momentum Index is with those of the MSCI World Value and Growth indices.

Source: AXA IM, Refinitiv, MSCI. All data in USD terms.

It’s very clear to see the impact of the post-pandemic growth phase of 2021 giving way to the inflationary and rate-sensitive environment of 2022, and Momentum’s correlation with Value becoming much stronger as a result.

So, what does this tell us about Momentum? In a way, Momentum is a multiplier, shifting its exposure to match whatever is in vogue, and as we end 2022 Momentum became more aligned with Value, with the correlation to Growth falling away slightly. This also works at the sector level. After a year of strong performance from the energy sector, according to data from Refinitiv, 25% of the iShares MSCI USA Momentum Factor ETF was allocated to energy stocks at the end of 2022. That figure was just 5% as the year started.

What could 2023 bring?

The beauty of factor investing is that historic trends can potentially give us insight into how we can expect stocks to perform in the future.

We are most positive on Quality moving into 2023. While it didn’t deliver its normal defensiveness in 2022, an economic slowdown means that investors will likely favour, and perhaps pay a premium for stocks with earnings growth. The broad-based underperformance of this factor in 2022 means that there are high-quality stocks at more attractive valuations, which may give this factor an extra boost in 2023.

This relative valuation argument makes us slightly less positive on Value. While we expect rising interest rates to be supportive of Value, the valuation gap with Quality/Growth has made this trade less compelling, and cyclical Value (oil for example) may start to underperform in a recessionary environment.

Valuation also is one reason why we are neutral on Low volatility as a style into 2023; prices of this group of stocks are elevated after 2022 but we believe there could be more volatility given the huge uncertainty around the macroeconomic outlook. An allocation to Low volatility could be an important defensive position in the coming year but with the risk of underperformance if macroeconomic conditions surprise on the upside.

Momentum is our least favoured factor, certainly Momentum based on price rather than more fundamental metrics such as earnings revisions. Momentum can swing quickly should the geopolitical or macroeconomic situation change, but we believe the inherent lag in typical price momentum metrics could be a headwind in an uncertain 2023, where short-term relief rallies and periods of volatility may make trend following more difficult.

Staying diversified

Given the outlook for 2023, we believe that investors could be best suited by a diversified exposure to factors. We believe that Quality and Low volatility could potentially offer the best combination of factors for investors to navigate whatever 2023 may bring, and active management using factors could be better rewarded than passively allocating to naïve, commoditised factors given the extreme price movements seen in 2022. The coming year is unlikely to be a smooth ride for equity investors, and diversification of styles and exposures could be more important than it has been in recent years.

Disclaimer

BNP Paribas Group's acquisition of AXA Investment Managers was completed on 1 July 2025, and AXA Investment Managers is now part of BNP Paribas Group.

This website is published by AXA Investment Managers Asia (Singapore) Ltd. (Registration No. 199001714W) for general circulation and informational purposes only. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute on the part of BNP Paribas Asset Management or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities. It has been prepared without taking into account the specific personal circumstances, investment objectives, financial situation or particular needs of any particular person and may be subject to change without notice. Please consult your financial or other professional advisers before making any investment decision.

Due to its simplification, this publication is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this publication is provided based on our state of knowledge at the time of creation of this publication. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

All investment involves risk, including the loss of capital. The value of investments and the income from them can fluctuate and investors may not get back the amount originally invested. Past performance is not necessarily indicative of future performance.

Some of the Services and/or products may not be available for offer to retail investors.

This publication has not been reviewed by the Monetary Authority of Singapore.