Investment Strategy Outlook – Modest growth, modest returns

Key points

- Given bond yields hit multi-year highs in late 2023 we see strong potential for capital gains from here

- Corporate bond returns should benefit from a more benign interest rate outlook – with investment grade offering especially attractive yields

- If interest rates and bond yields move lower, and growth continues, investors could see the positive equity momentum sustained

- Bias is skewed towards bonds as here the risk premium has emerged; in equities it has eroded

Slower growth threatens equities

There was no recession in 2023 and interest rates rose further than most had expected. This backdrop turned out to be much better for equity investors than for bond holders, as it reflected a strong economy, especially in the US. The cumulative outperformance of global equities relative to government bonds since the end of 2020 has been the third strongest of the last 40 years.

But we don’t expect a recession in 2024. We forecast modest GDP growth, further easing of inflation and some limited cuts in interest rates. Nominal GDP growth will be lower. One key risk is that eventually a recession will arrive as “higher for longer” interest rates eventually impact activity. Such a backdrop suggests a reduction – possibly even a reversal – in relative equity outperformance. By contrast, bonds should decisively shake off their losing streak.

Rates to remain high

There are nuances in our outlook. Interest rates may have peaked but inflation will remain above target in 2024. The “higher for longer” narrative from central banks will prevail and there will only be limited scope for rate cuts until there is evidence of easing labour market pressures. That should not put investors off investing in fixed income. Higher rates from here are unlikely unless there is another inflation shock. That reduces downside risk from any re-setting (higher) of rate expectations. A higher yield starting point is also a positive. Over a one-year horizon, the total return skew from buying bonds today is much more positive than it was at the start of 2022. In the risk scenario of even weaker growth and a more dovish pivot in central bank rhetoric – and even policy – there is more optionality for capital gains in fixed income than there is scope for drawdowns.

As rates increased, so did measures of interest rate volatility and of the estimated term premium in yield curves. The absence of central banks scooping up government bonds has contributed to increasingly uncertain bond returns – reinforced by higher short rates, inflation and concerns over higher fiscal deficits. On the plus side, investors get paid more for taking bond risk. A higher risk premium in the yield curve and higher interest rates, relative to equity volatility, are further supports for a more positive view.

Credit attractive

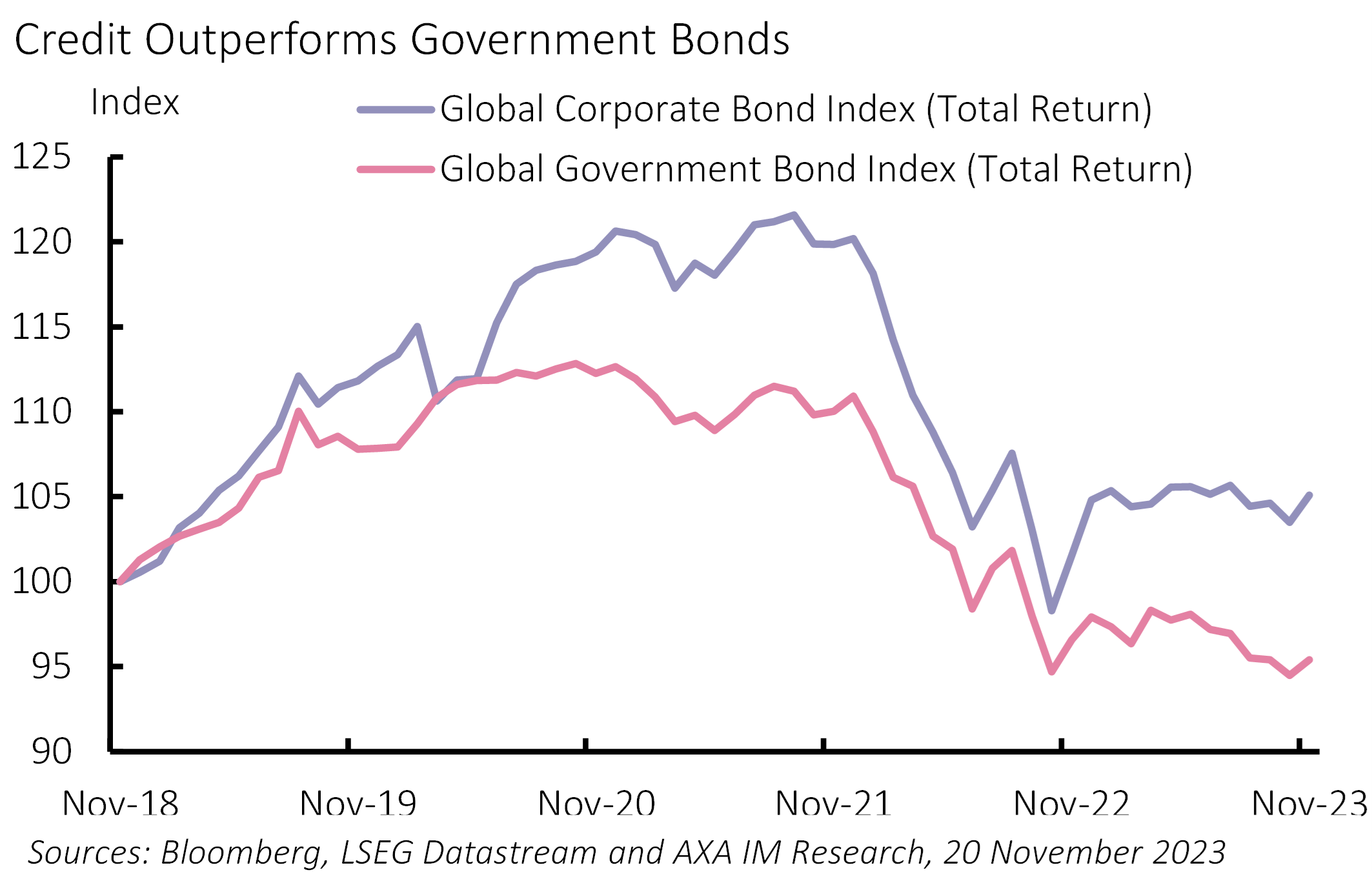

Corporate bond returns should benefit from a more benign rate outlook. Credit risk premiums have been generally stable during 2023, helping corporate bonds outperform government bonds (Exhibit 1). The current macro forecast supports a continued solid performance from corporate bond markets, with investment grade bonds offering yields close to 6% in the US and 4.25% in Europe.

Exhibit 1: Credit Outperforms Government Bonds

Credit risk is manageable in modest growth

It is a fact that corporates are likely to face higher financing costs should they need to raise debt in the next couple of years compared to the average coupon on their existing bonds. However, lower rates in 2024 and 2025 and the fact the volume of bonds maturing in the short term is relatively limited means refinancing risks should be limited. High-grade companies extended their debt during the low yield period and have manageable levels of leverage, having benefitted from strong nominal revenue growth in the last three years.

Credit investors need to watch equities though. Any earnings deterioration or increase in equity price volatility would likely push credit spreads wider. This relationship is stronger in the high yield parts of the credit market. Credit spreads, in both US high grade and high yield markets, have been around the 50th percentile of their distribution over the last 10 years. European risk premiums are in the 80th, suggesting there is more value in euro credit through the lens of risk mitigation.

Spread widening is a risk on any general deterioration in the risk environment. However, there has been no excess credit cycle and balance sheets are stronger than in previous tightening episodes. As such, spread widening would create opportunities for investors, especially with lower rates providing cheaper financing for borrowers. The bottom line is that overall yields are attractive relative to where we expect short rates and inflation to end up in 2024.

Bond versus equity risk

In the US, the bond and equity relationship dynamic has moved to the extreme. Real yields on US Treasury Inflation Protected Securities (TIPS) are higher than the dividend yield on the US equity market. More sophisticated measures of the equity risk premium put it at a multi-year low. Moreover, equity volatility has fallen relative to interest rate volatility. Lower nominal growth should benefit bonds to the detriment of stocks.

Uncertain earnings outlook

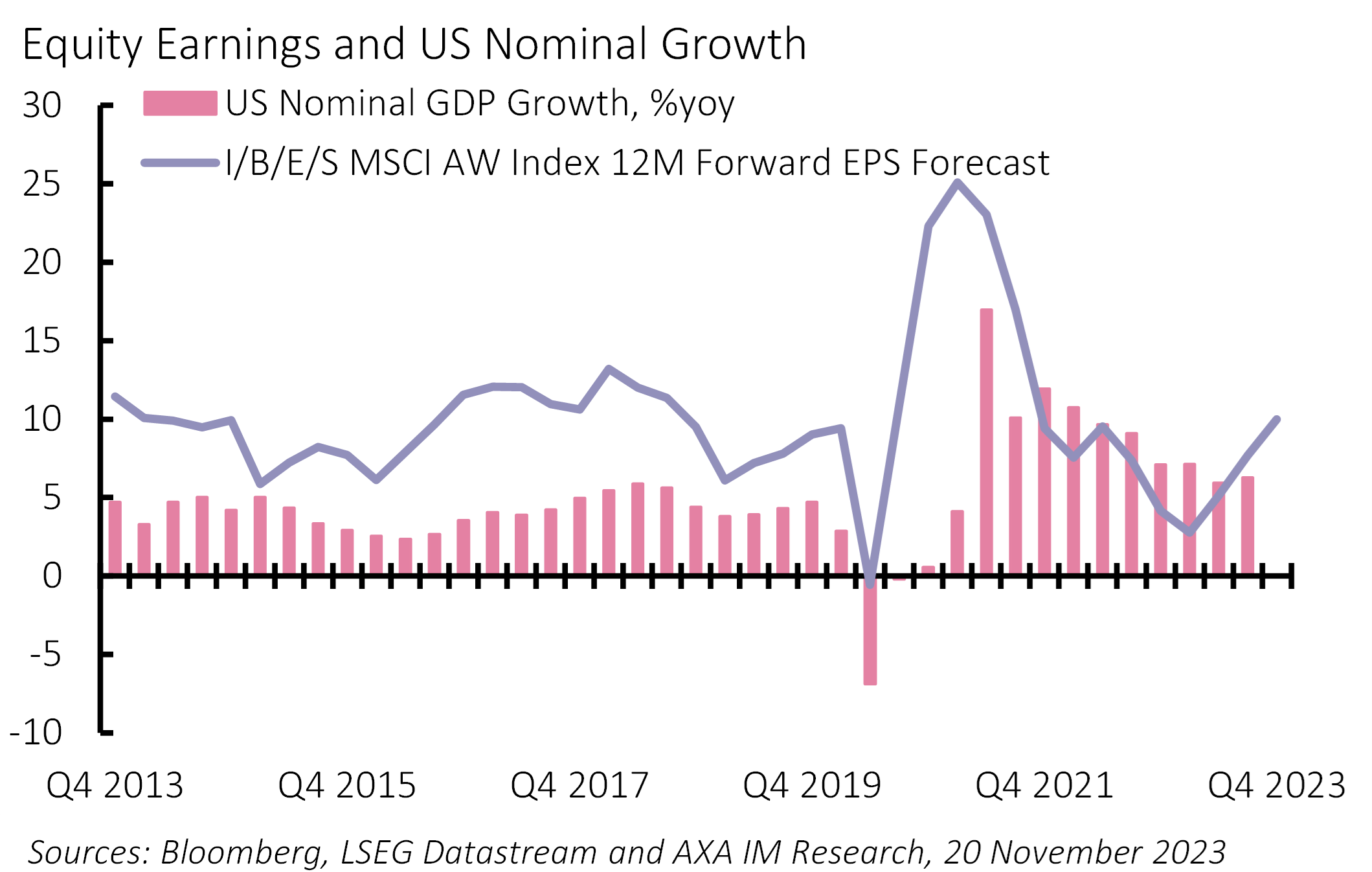

Earnings expectations for 2024 are solid for the US and other equity markets, and US equity valuations are higher than their long-term average. That situation could persist in a ‘Goldilocks’ type soft landing. AXA IM’s implied nominal GDP growth forecast for the US could be enough to allow the 10% to 12% bottom-up expectation of earnings growth to be met. However, the risks are to the downside. As US companies reported Q3 2023 earnings, which were generally a little better than expected, many suggested some downside risks to revenues and margins going forward. Should there be any evidence that earnings growth is weakening in the early part of 2024, then current valuations in the US might not be sustained.

A soft landing can support stocks

However, we cannot discount the equity bull market continuing. Easier financial conditions coming from slightly lower interest rates and bond yields – and continued positive real growth – could sustain positive sentiment towards stocks. Add in the ongoing excitement around artificial intelligence and its potential to boost growth, and certain parts of the stock market could continue to deliver strong earnings growth and returns to investors (Exhibit 2). While bond performance was disappointing in 2023, a portfolio weighted to short-duration credit and long-duration technology stocks would have been a very good performer. Until the Federal Reserve pivots, such a barbell strategy could continue to be so.

European investors will face lower equity valuations and lower bond yields relative to the US market. The backdrop looks set for weaker growth and lower inflation, with a European Central Bank which might also be hesitant to pivot. Real yields are lower and the valuation gap between equities and bonds is still stacked more in stocks’ favour. To the extent the US has more scope for disappointment on growth and for interest rate expectations to change, European markets might be less volatile but still able to deliver positive returns for investors across asset classes.

Exhibit 2: EPS forecasts look optimistic

Evenly balanced

Modest investment returns based on a modest nominal growth outlook is the core view. The bias is more towards fixed income given that is where the risk premium has emerged over the last year, while in equities it has eroded.

In addition, the relative implied volatility of rates versus equities is also an indicator supporting a positive view on bonds. With rates peaking and inflation falling, uncertainty around rates should decline and, directionally, we expect the yields to be lower.

For risk assets there is less risk premium to compensate for growth and earnings uncertainty. The lack of an ‘irrational’ credit cycle and reasonable credit spread levels offer some comfort to credit investors with huge demands from corporate refinancing needs not a major negative for investors in 2024.

Equities benefitted from upside growth surprises in 2023. After another year of tightening giving the famous lags more time to work, the risk lies the other way round for equities now. A deterioration in the expected risk adjusted return profile is likely to be the result.

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

It has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. Its analysis and conclusions are the expression of an opinion, based on available data at a specific date.

All information in this document is established on data made public by official providers of economic and market statistics. AXA Investment Managers disclaims any and all liability relating to a decision based on or for reliance on this document. All exhibits included in this document, unless stated otherwise, are as of the publication date of this document.

Furthermore, due to the subjective nature of these opinions and analysis, these data, projections, forecasts, anticipations, hypothesis, etc. are not necessary used or followed by AXA IM’s portfolio management teams or its affiliates, who may act based on their own opinions. Any reproduction of this information, in whole or in part is, unless otherwise authorised by AXA IM, prohibited.

Neither MSCI nor any other party involved in or related to compiling, computing or creating the MSCI data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Without limiting any of the foregoing, in no event shall MSCI, any of its affiliates or any third party involved in or related to compiling, computing or creating the data have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages. No further distribution or dissemination of the MSCI data is permitted without MSCI’s express written consent.

Disclaimer

BNP Paribas Group's acquisition of AXA Investment Managers was completed on 1 July 2025, and AXA Investment Managers is now part of BNP Paribas Group.

This website is published by AXA Investment Managers Asia (Singapore) Ltd. (Registration No. 199001714W) for general circulation and informational purposes only. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute on the part of BNP Paribas Asset Management or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities. It has been prepared without taking into account the specific personal circumstances, investment objectives, financial situation or particular needs of any particular person and may be subject to change without notice. Please consult your financial or other professional advisers before making any investment decision.

Due to its simplification, this publication is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this publication is provided based on our state of knowledge at the time of creation of this publication. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

All investment involves risk, including the loss of capital. The value of investments and the income from them can fluctuate and investors may not get back the amount originally invested. Past performance is not necessarily indicative of future performance.

Some of the Services and/or products may not be available for offer to retail investors.

This publication has not been reviewed by the Monetary Authority of Singapore.