Investing in a sustainable future: Energy-efficient buildings

Green bonds are financial instruments designed to raise funds for projects that deliver positive environmental impacts.

Key facts and trends in buildings

Building sector

37% Global GHG emissions1

when including operational emissions (heating, cooling, lighting) and emissions from construction materials such as cement and steel.

Emissions trend

- Emissions have steadily increased over the past decades, largely driven by urbanization, population growth, and rising energy demand for heating, cooling, and appliances.

- Without significant changes, building emissions are expected to grow further by 30-50% by 2050 due to increased floor space and electrification demands, especially in emerging economies.

The road to net zero by 2050

To reach Net Zero by 2050, approximately US$2.5-3 trillion is required annually globally by 20302, focusing on energy efficiency retrofits, low-carbon construction materials, electrification of heating and cooling, and integration of smart building technologies. In 2024, energy efficiency investments in the building sector were around US$225 billion3, suggesting a shortfall of about U$2.3 trillion a year.

Where do green bonds fit in?

Green buildings

Eligible Projects Financed

- Energy Efficiency retrofits and renovations of existing buildings

- Construction of green certified new buildings

- Installation of on-site renewable energy systems

- Smart building infrastructure and energy management systems

Case study

Unibail-Rodamco-Westfield - Constructing a Sustainable Future

Unibail-Rodamco-Westfield (URW) is a leading European-listed real estate company headquartered in Paris, specializing in high-end commercial real estate. The company owns, develops, and operates major retail destinations under the Westfield brand in Europe and North America.

URW is redefining commercial spaces with sustainability at its core, with 90% of its European properties achieving top environmental ratings. In 2022, URW published its Green Financing Framework to finance or refinance green building projects through the issuance of green bonds.

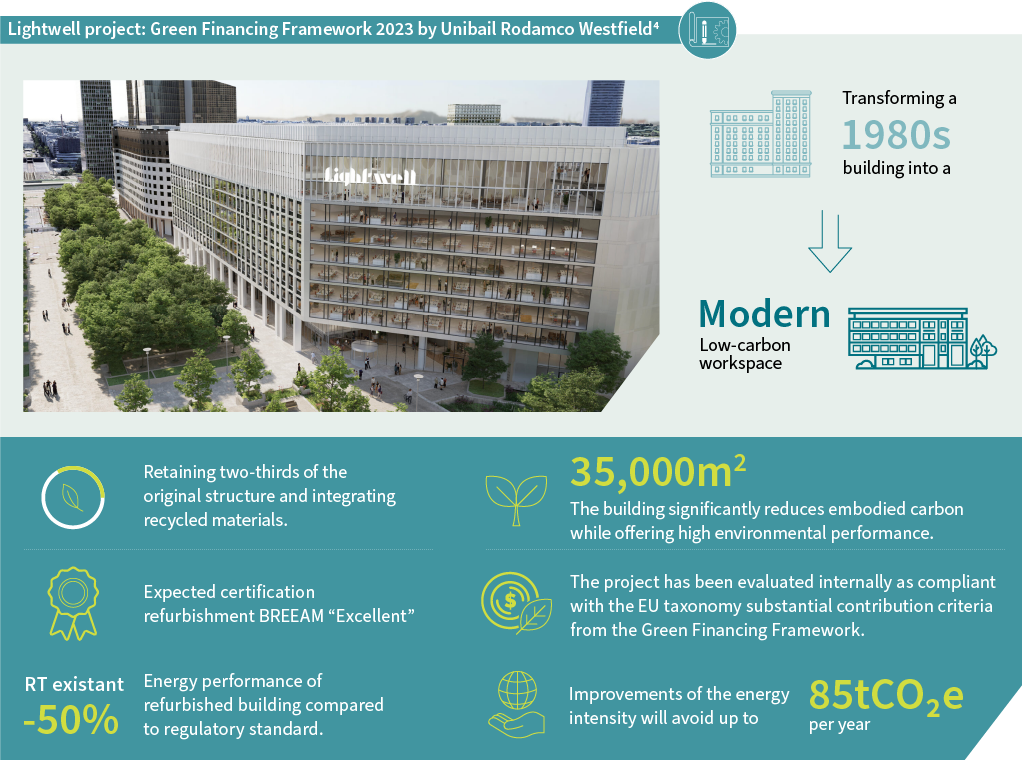

Its recent green bonds financed the Lightwell project—a major office building renovation, transforming a 1980s building into a modern, low-carbon workspace. By retaining two-thirds of the original structure and integrating recycled materials, the 35,000 m² building significantly reduces embodied carbon while offering high environmental performance.

Lightwell embodies URW’s forward-thinking approach to sustainable office development—combining environmental rehabilitation, architectural innovation, and tenant-focused design to create a next generation workplace anchored in ESG leadership and urban renewal.

Green bonds are one of the most appropriate debt instrument to accompany issuers committed to transition to a low carbon economy. It supports the decarbonization of the building and construction sector by channeling capital towards projects that reduce GHG emissions and provide investors with a higher level of transparency and measurability. Contact us to explore more.

Sources:

[1]Source: UN Global Status Report for Buildings and Construction

[2]Source: World Economic Forum – Building the Gap: How to finance the net zero transition.

[3]Source: BloombergNEF Report, 30 January 2025, Global Investment in the Energy Transition Exceeded US$2 Trillion for the First time in 2024

[4]Source: Lightwell project: Green Financing Framework 2023 by Unibail Rodamco Westfield

Disclaimer

BNP Paribas Group's acquisition of AXA Investment Managers was completed on 1 July 2025, and AXA Investment Managers is now part of BNP Paribas Group.

This website is published by AXA Investment Managers Asia (Singapore) Ltd. (Registration No. 199001714W) for general circulation and informational purposes only. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute on the part of BNP Paribas Asset Management or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities. It has been prepared without taking into account the specific personal circumstances, investment objectives, financial situation or particular needs of any particular person and may be subject to change without notice. Please consult your financial or other professional advisers before making any investment decision.

Due to its simplification, this publication is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this publication is provided based on our state of knowledge at the time of creation of this publication. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

All investment involves risk, including the loss of capital. The value of investments and the income from them can fluctuate and investors may not get back the amount originally invested. Past performance is not necessarily indicative of future performance.

Some of the Services and/or products may not be available for offer to retail investors.

This publication has not been reviewed by the Monetary Authority of Singapore.