Take Two: World Bank lifts global GDP forecast; US inflation holds steady

What do you need to know?

The global economy is proving more resilient than expected despite persistent trade tensions and policy uncertainty, according to the World Bank. It lifted its global GDP growth forecast to 2.6% for 2026 and 2.7% for 2027, from the 2.4% and 2.6% respectively it predicted in June, its latest Global Economic Prospects report showed. The upgrade was partly driven by better-than-expected growth in the US. However, while nearly 90% of advanced economies have recovered to above pre-pandemic per capita income levels, more than a quarter of emerging and developing economies are poorer than they were in 2019, the report said.

Around the world

Gold and silver hit record highs last week amid a backdrop of Federal Reserve autonomy concerns, geopolitical tensions and benign US inflation data. The yellow metal, often regarded as a so-called ‘safe haven’ during volatile periods, broke through the $4,600-per-ounce mark early in the week. Separately, US annual inflation remained unchanged at 2.7% in December and in line with expectations, raising hopes of interest rate cuts later this year. Elsewhere, the UK’s FTSE 100 and Japan’s Nikkei 225 reached fresh record highs. Japan’s market rallied amid expectations of a snap election in February that could lead to further fiscal stimulus from the Japanese government.

Figure in focus: 1973

Coal power generation fell in China and India last year, the first simultaneous drop since 1973, a new Carbon Brief analysis found. Electricity generation from coal dropped 3% in India and 1.6% in China, as both countries added record amounts of clean energy. This is significant as China and India’s power sectors drove 93% of the rise in global carbon dioxide emissions between 2015 and 2024, Carbon Brief said. Meanwhile, US coal power generation rose 13% last year, contributing to a 2.4% rise in US greenhouse gas emissions, due to higher natural gas prices and growing power demand, according to a separate report from Rhodium Group.

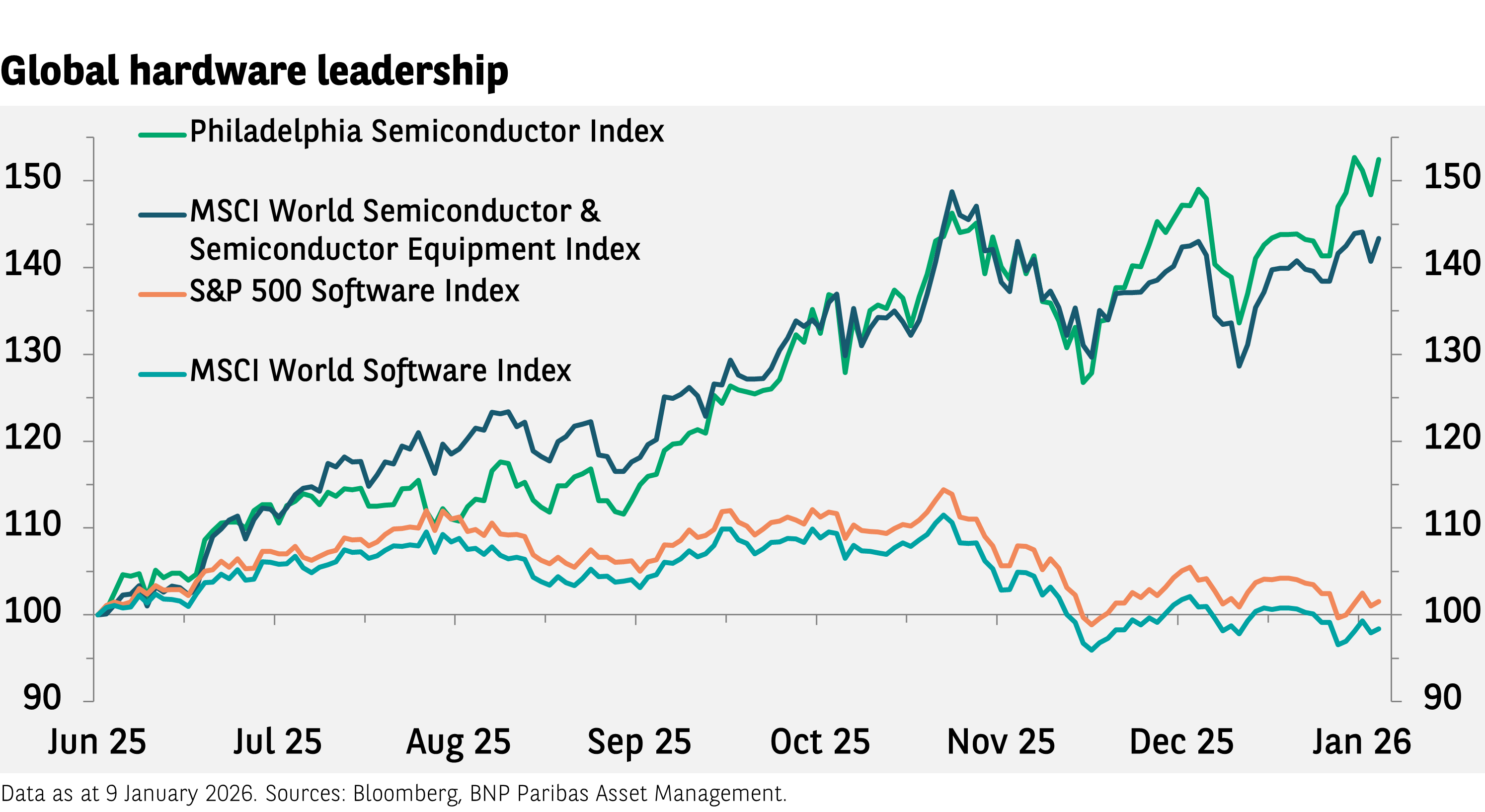

Chart of the week

The recent technology equity rally - in the US and beyond - has been driven less by the companies developing the core artificial intelligence (AI) technologies themselves and more by the so-called “picks and shovels” firms - the suppliers of essential infrastructure and tools supporting AI growth. These include semiconductor manufacturers, hardware providers, as well as providers of cloud computing platforms, all of which are expected to benefit from the increasing capital expenditure associated with AI development.

Words of wisdom

Global Cooperation Barometer: Created by the World Economic Forum with McKinsey & Company, this is a measurement of 41 indicators of global cooperation across five pillars: trade and capital; innovation and technology; climate and natural capital; health and wellness; and peace and security. The most recent report, which combines both 2024 and 2025 findings, showed that overall, cooperation held steady, but its composition is evolving as “smaller and more adaptive cooperative coalitions are emerging.” There was greater cooperation across innovation and technology and climate and natural capital. However, cooperation in trade and capital flattened, and continued to decrease in peace and security, as conflicts escalated.

What’s coming up?

Monday sees the Eurozone and Canada report inflation numbers while China issues fourth quarter (Q4) economic growth data. On Tuesday and Wednesday the UK updates markets respectively with its latest unemployment and inflation reports. The US posts its final Q3 economic growth estimate on Thursday while the Bank of Japan holds its first monetary policy meeting of the year on Friday. Several Purchasing Managers’ Indices are also released on Friday, including those covering Japan, the Eurozone, US and UK. The World Economic Forum’s annual meeting in Davos runs from Monday to Friday, where leaders will convene to discuss critical global challenges under the theme of A Spirit of Dialogue.

Read more insights at the Investment Institute

Disclaimer

BNP Paribas Group's acquisition of AXA Investment Managers was completed on 1 July 2025, and AXA Investment Managers is now part of BNP Paribas Group.

This website is published by AXA Investment Managers Asia (Singapore) Ltd. (Registration No. 199001714W) for general circulation and informational purposes only. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute on the part of BNP Paribas Asset Management or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities. It has been prepared without taking into account the specific personal circumstances, investment objectives, financial situation or particular needs of any particular person and may be subject to change without notice. Please consult your financial or other professional advisers before making any investment decision.

Due to its simplification, this publication is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this publication is provided based on our state of knowledge at the time of creation of this publication. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

All investment involves risk, including the loss of capital. The value of investments and the income from them can fluctuate and investors may not get back the amount originally invested. Past performance is not necessarily indicative of future performance.

Some of the Services and/or products may not be available for offer to retail investors.

This publication has not been reviewed by the Monetary Authority of Singapore.