Investing in a sustainable future: Renewable energy

Green bonds are financial instruments designed to raise funds for projects that deliver positive environmental impacts.

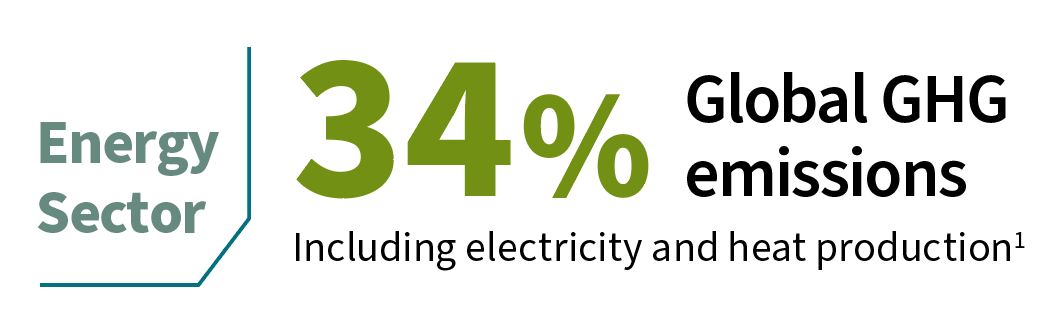

Key facts and trends in renewable energy

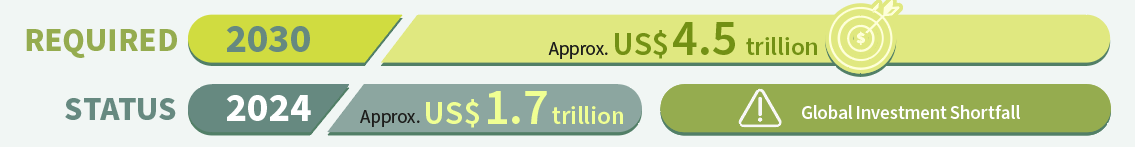

The road to net zero by 2050

To reach Net Zero by 2050, approximately US$4.5 trillion is required annually by 20303, mostly in renewable power, grids, storage, and efficiency. In 2024, global investments in clean energy totaled approximately US$ 1.7 trillion4, suggesting a shortfall of US$2-2.8 trillion annually.

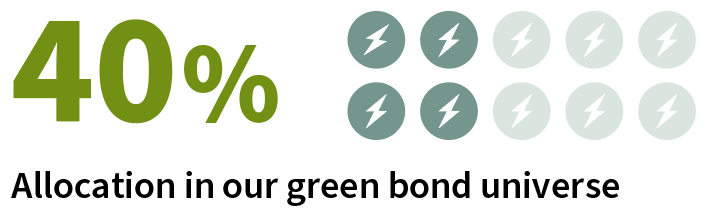

Where do green bonds fit in?

Smart Energy Solutions

Eligible Projects Financed

- Renewable energy (solar, wind power generation, hydropower with sustainability safeguards)

- Grid infrastructure upgrades and interconnections

- Battery and storage projects

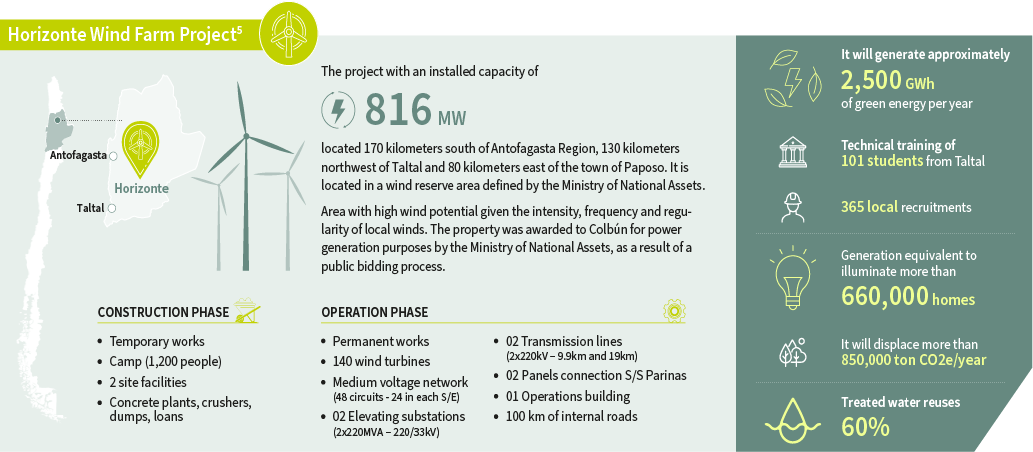

Case study

Colbún S.A. - A Green Revolution in Chile

Colbún S.A. is a major Chilean electric utility company that produces, transmits, and distributes electricity primarily across the central and southern regions of Chile. The company is committed to achieving carbon neutrality by 2050 and plans to phase out from coal by 2040, with the closure of its last coal power plant.

Its Green Financing Framework, published in 2021, supports projects that enhance energy efficiency and promote renewable energy. The company has also implemented adequate measures to manage and mitigate potential environmental and social risks associated with the projects financed under this framework.

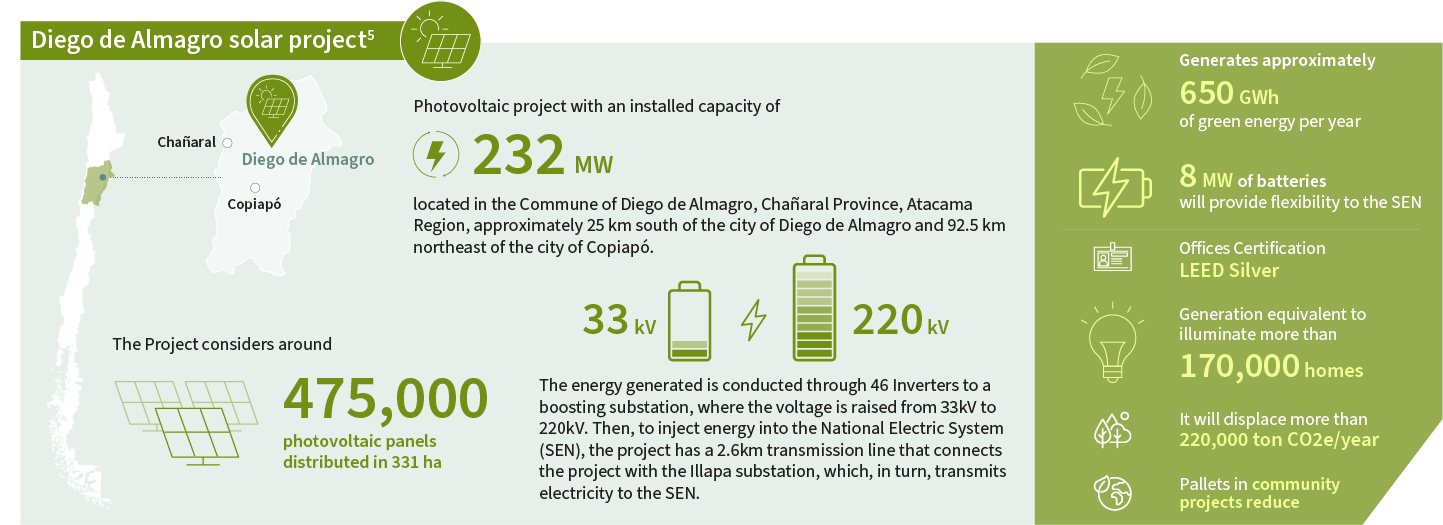

By issuing its first green bond, Colbún is financing two major projects focused on wind and solar energy. The Horizonte Wind Farm project harnesses strong winds to generate large-scale energy, while the Diego de Almagro solar project produces solar energy combined with battery storage for enhanced grid flexibility. Together, these initiatives aim to reduce carbon emissions by over 1 million tonnes annually, create hundreds of jobs, and engage local communities through training and supplier inclusion, all while supporting Chile’s ambitious climate goals.

Green bonds are one of the most appropriate debt instrument to accompany issuers committed to transition to a low carbon economy. It supports the decarbonization of the energy sector by channeling capital towards projects that reduce GHG emissions and provide investors with a higher level of transparency and measurability. Contact us to explore more.

Sources:

[1]Source: Global Greenhouse Gas Overview by United States Environmental Protection Agency. Data from IPCC (2022)

[2]Source: IEA https://www.iea.org/data-and-statistics/data-tools/greenhouse-gas-emissions-from-energy-data-explorer

[3]Source: World Economic Forum IEA: Clean energy investment must reach $4.5 trillion per year by 2030 to limit global warming to 1.5°C | World Economic Forum

[4]Source: IEA’s World Energy Investment 2023

[5]Source: Colbun's Green Bond Impact Report June 2023

Disclaimer

BNP Paribas Group's acquisition of AXA Investment Managers was completed on 1 July 2025, and AXA Investment Managers is now part of BNP Paribas Group.

This website is published by AXA Investment Managers Asia (Singapore) Ltd. (Registration No. 199001714W) for general circulation and informational purposes only. It does not constitute investment research or financial analysis relating to transactions in financial instruments, nor does it constitute on the part of BNP Paribas Asset Management or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities. It has been prepared without taking into account the specific personal circumstances, investment objectives, financial situation or particular needs of any particular person and may be subject to change without notice. Please consult your financial or other professional advisers before making any investment decision.

Due to its simplification, this publication is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this publication is provided based on our state of knowledge at the time of creation of this publication. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

All investment involves risk, including the loss of capital. The value of investments and the income from them can fluctuate and investors may not get back the amount originally invested. Past performance is not necessarily indicative of future performance.

Some of the Services and/or products may not be available for offer to retail investors.

This publication has not been reviewed by the Monetary Authority of Singapore.